🔥 This offer expires in:

🔥 This offer expires in:

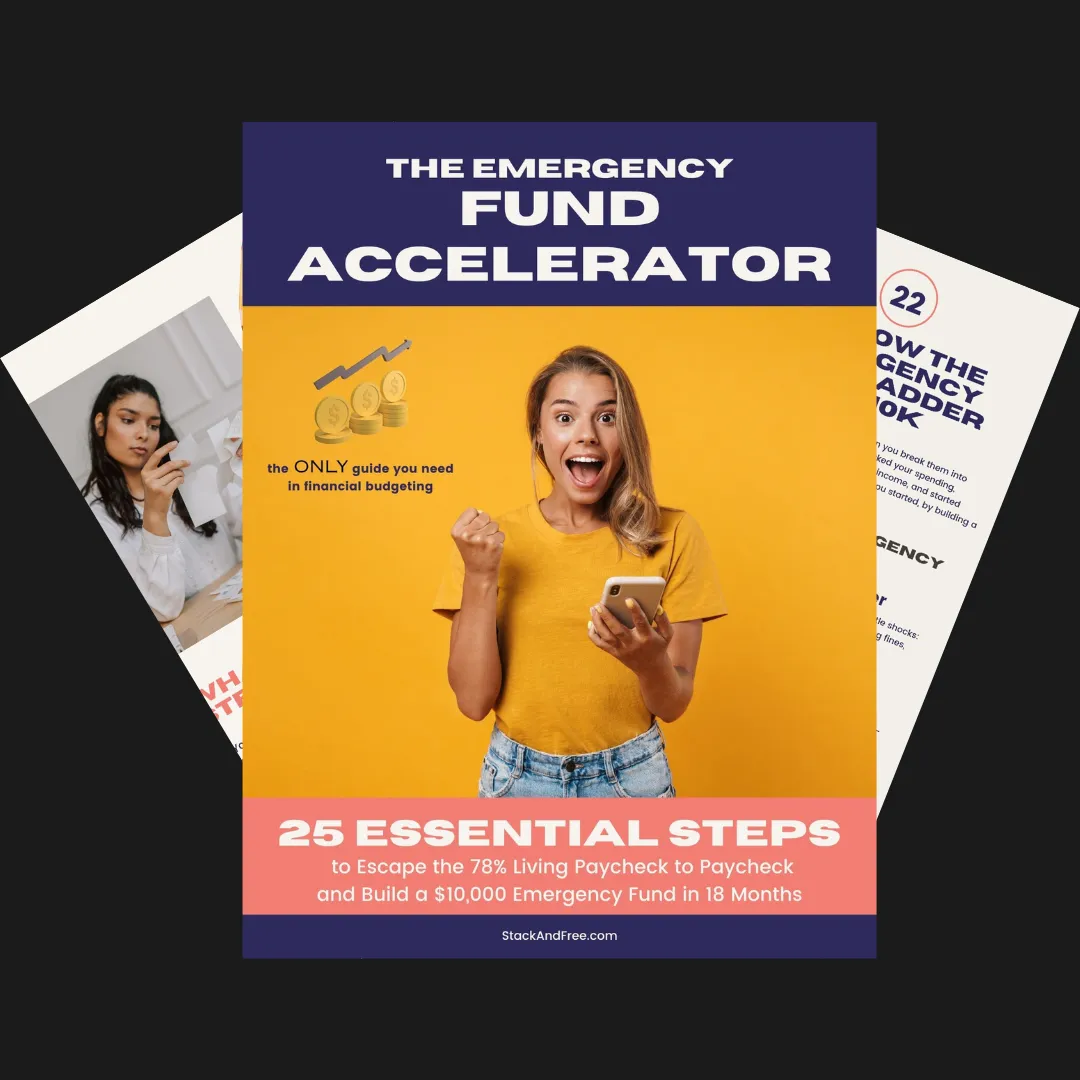

For Everyday Earners Trapped in the Paycheck-to-Paycheck Cycle

25 Essential Steps to Escape the 78% Living Paycheck to Paycheck & Build Your Emergency Fund Within 90 Days

Without needing a degree in finance, cutting out your morning coffee, or following complicated spreadsheets that make your head spin. The Emergency Fund Accelerator is your straightforward roadmap to finally knowing where your money goes and building the financial buffer that 60% of people can't even imagine having.

4.8 / 5 based on 1,211 reviews

JORDAN RAY

FREELANCER & SINGLE MUM

I used to make decent money, but I always felt broke. I had no idea where it all went. I'd avoid looking at my bank app, and felt constant guilt after every “little” spend. But this guide changed everything. For the first time, I know where my money’s going, and I’ve already saved more in the past 3 months than the last 3 years combined.

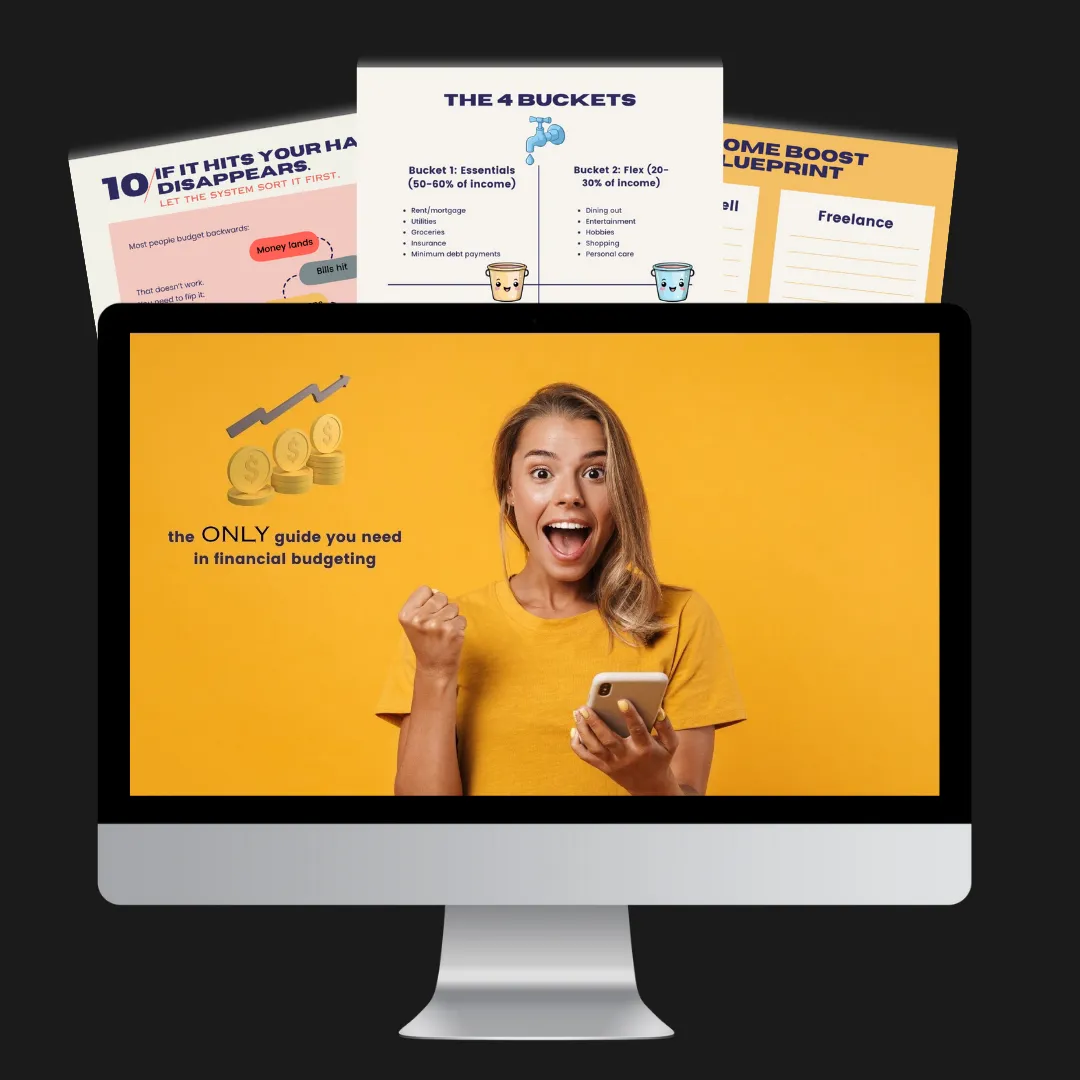

INTRODUCING THE BUDGET BREAKTHROUGH BLUEPRINT

78% of Working Adults Live Paycheck to Paycheck - Even on "Good" Incomes

Is Your Money Working for You - or Just Disappearing?

Every month, millions of professionals, creatives, and parents make decent money - yet feel financially anxious, behind, and drained.

Why? Because most were never taught how to actually manage cash flow. Instead, they try to "wing it," check their balance constantly, avoid budgeting apps that never stick, and hope next month will be better.

Meanwhile:

> 61% couldn’t cover a $1,000 emergency today

> 74% of people with a budget still overspend

> And only 16% of us ever received financial literacy education

This guide gives you a better way - one that doesn’t rely on financial advisors, spreadsheets, or guilt.

You’ll learn to:

> See exactly where your money is going

> Set up a calm, automated system that fits your real life

> Plug the hidden leaks draining your income

> Stack your first $500, and build toward $10,000 in savings

> Finally feel confident, not chaotic, when you check your bank account

All it takes is a simple system, 25 clear steps, and a willingness to face the numbers.

Stop the Silent Leak

Subscription creep, unconscious card taps, and lifestyle drift quietly drain your income.

This guide helps you identify and plug the leaks so you stop losing money without realizing it - and start stacking savings without cutting your lifestyle.

The Clarity the Top 1% Have

Most People Budget in Their Heads. The Wealthy Use Systems. This guide walks you through a step-by-step money flow system that helps you think, spend, and plan like the financially elite, without needing an accounting degree.

You're Losing More Than You Think

Most people overspend by 20–30% without noticing - not because they’re reckless, but because they’re untracked. This guide shows you exactly where your money goes, and how to stop the leaks so you can finally keep more of what you earn.

Build Wealth in 10 Minutes a Week

Budgeting isn’t about spreadsheets. It’s about clarity. Our proven system takes less than 10 minutes a week to review, so you can stay in control without overthinking or obsessing over every penny.

MORE THAN JUST A PDF

Knowledge is power. Introducing your superpower...

Right after your download, you’ll have instant access to a full, 25-step system designed to take you from paycheck-to-paycheck to fully stacked and stress-free.

What You’re Getting Inside:

A Zero-Fluff, Action-First Financial Reset

You’re not just reading - you’re building a money system that works. Each part consists of practical solutions, exercises to get you thinking about your spending behaviour, and step by step guide to attaining your $10,000 savings.

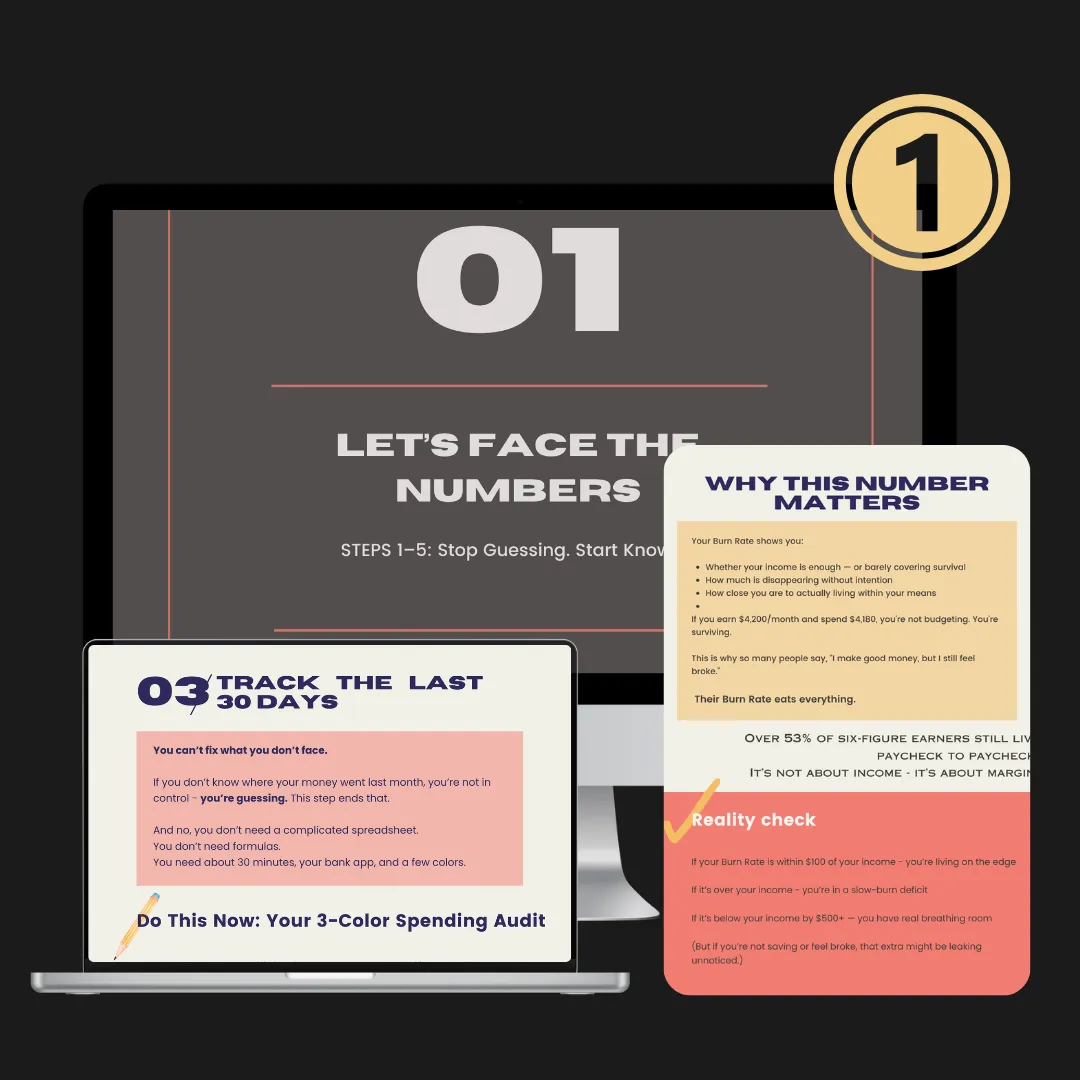

Part 1: Let's Face the Numbers

You’ll walk away with full clarity on where your money disappears - and how to take it back.

See where your money actually goes

Stop guessing - and stop overspending without realizing

Plug invisible leaks and take back control

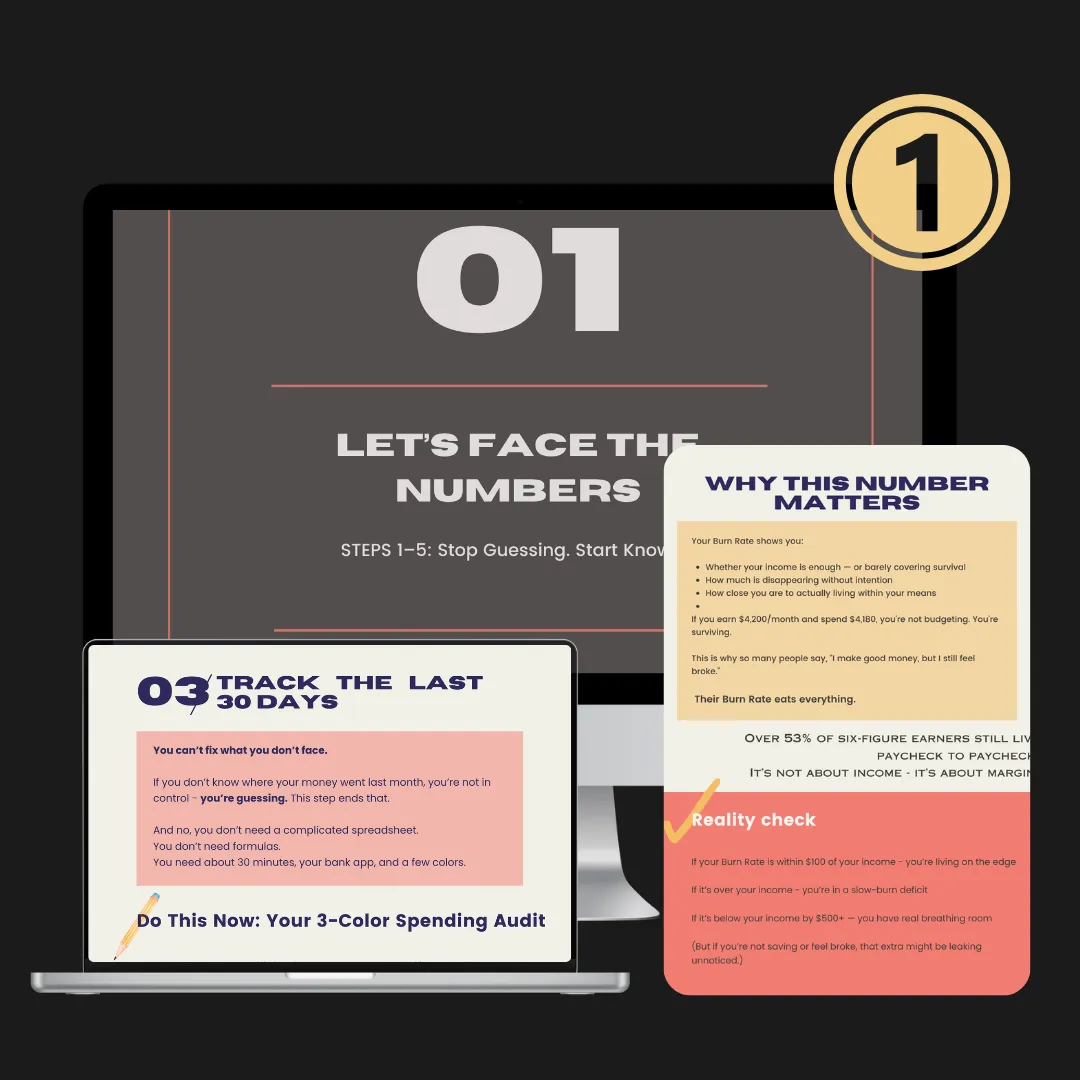

Part 2: Reset Your Mindset

These steps help you build confidence, not guilt, and create habits that stick.

Break the guilt + shame cycle around money

Build confidence with each decision

Reframe budgeting as a tool for freedom, not restriction

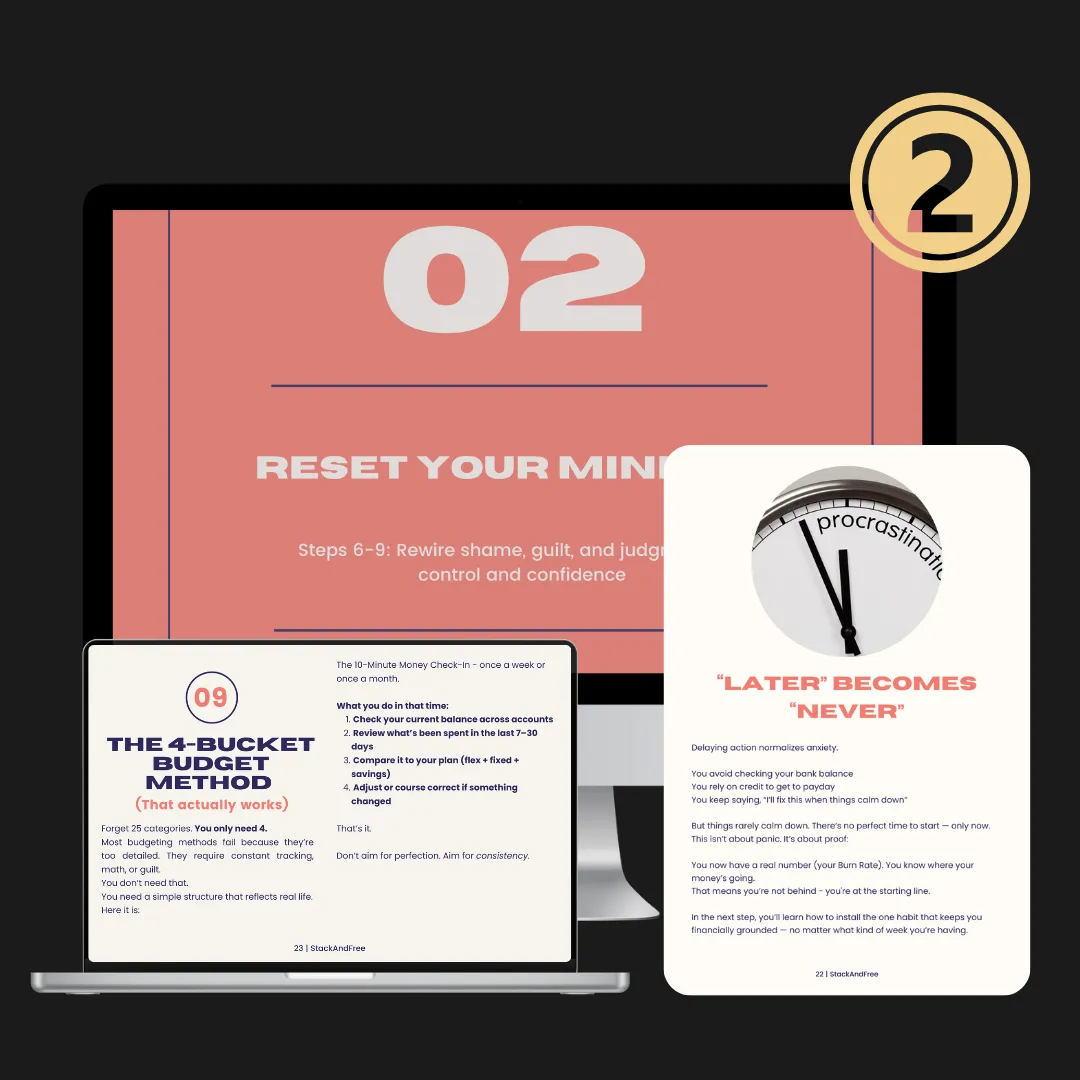

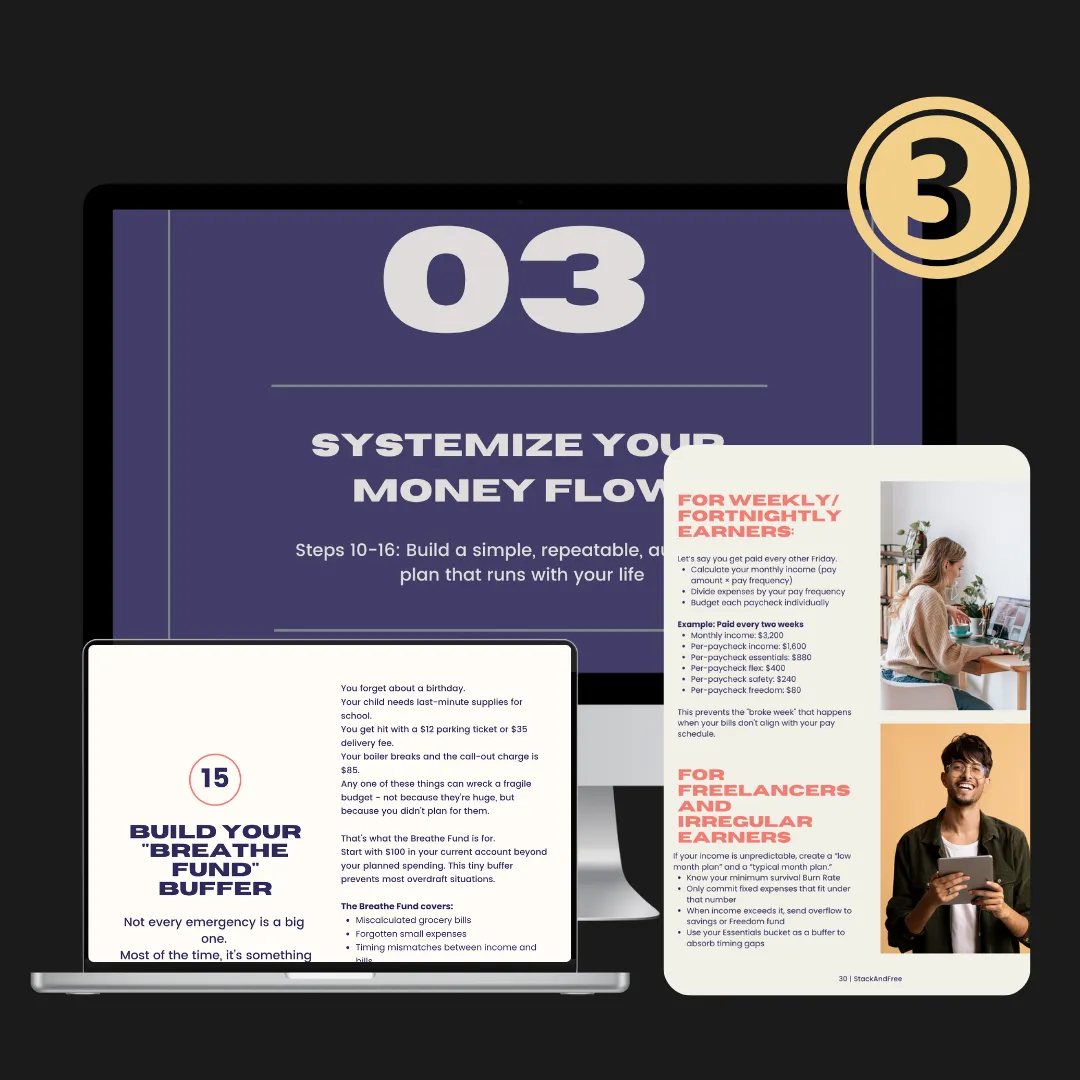

Part 3: Systemize Your Money Flow

You’ll stop reacting to money and start directing it

No more chaos. Just a calm, automated system that fits your life

Build a money system that fits your lifestyle

Sync your spending with your actual pay cycle

Automate everything - bills, savings, peace of mind

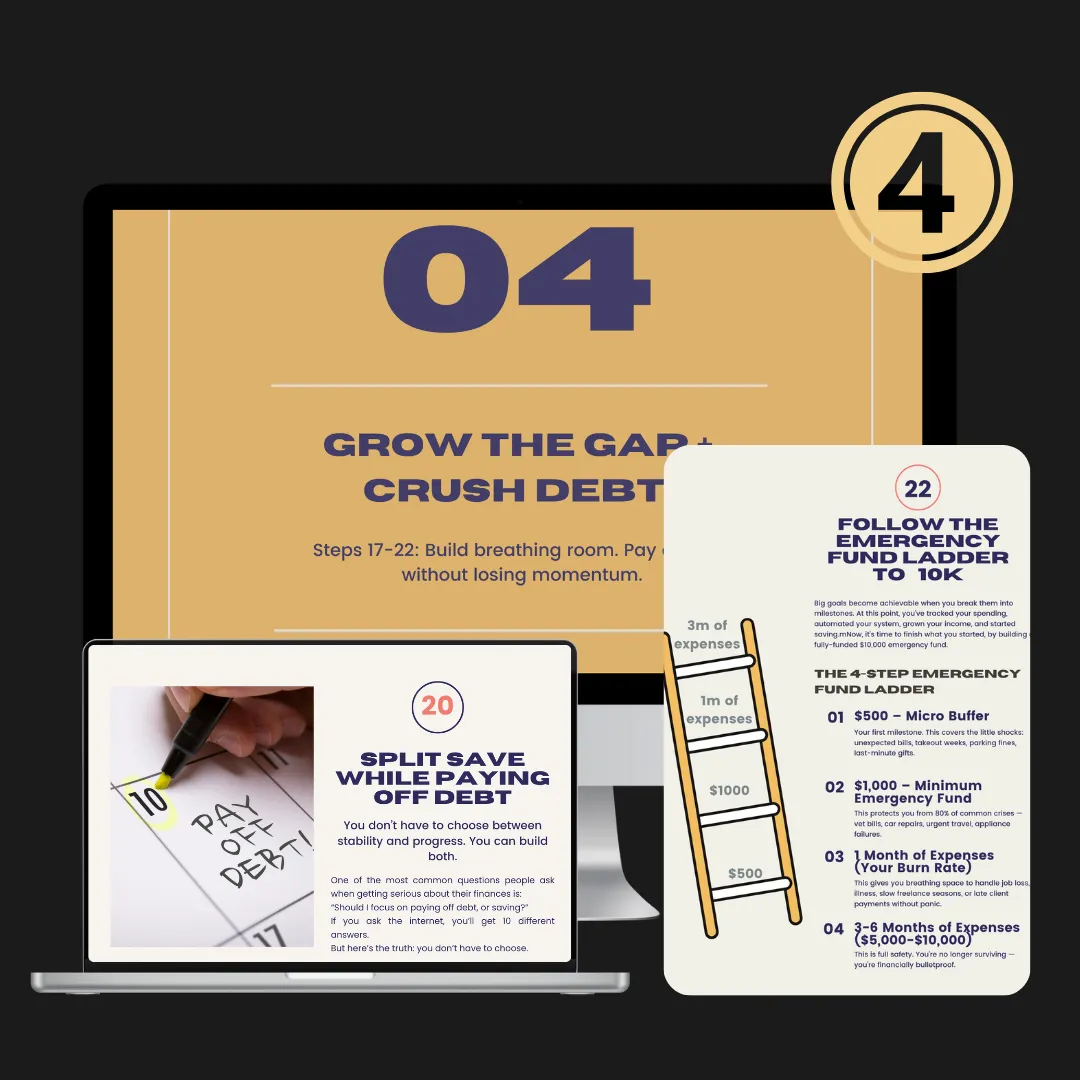

Part 4: Grow the Gap +

Crush Debt

Your first $500 → $10,000 emergency fund starts here.

Go from $0 to $10K with our 4-step emergency fund ladder

Start with just $500 - and build momentum without a raise

Gain real peace of mind knowing you’re covered

Part 5: Lock It In For Life

This isn’t a one-time fix. These final steps help you stay in control, even when life changes.

Monthly check-in system (takes under 10 mins)

Adjust when life shifts - without stress

Build real habits that stick for life

TAKE BACK CONTROL OF YOUR FINANCES STARTING TODAY WITH OUR $196 VALUE BUNDLE FOR JUST $17!

4.8 / 5 based on 1,211 reviews

Exclusive Bonuses Just For YOU!

Along with your The Emergency Fund Accelerator guide, you’ll unlock these premium bonuses - built to fast-track your financial breakthrough.

Each one complements your journey toward clarity, control, and long-term wealth.

Act now to access them instantly after purchase.

BONUS 1: Top 8 Investment Tools Used by the Top 1% - WORTH $39

Get behind-the-scenes access to the tools high-net-worth individuals use to grow and protect wealth, simplified for everyday earners.

BONUS 2: 25 Books the Banks Don’t Want You to Read - WORTH $39

A powerful reading list curated to open your eyes to the real rules of money - covering mindset, wealth systems, and how banks profit off your silence.

BONUS 5: 8 Passive Income Ideas (You Can Start in Under 10 Minutes a Day) - WORTH $59

Kickstart extra income with these quick and easy passive income ideas that fit into any schedule.

All bonuses delivered instantly after download.

Limited-time only.

No recurring fees. No upsells. Just real tools that help you build margin, momentum, and money clarity.

READY TO GET STARTED?

Get The Emergency Fund Accelerator PDF Today!

With the StackAndFree bundle, you’ll gain immediate access to the exact 25-step system that helps smart earners stop living paycheck to paycheck - and finally stack your first $10K. For a limited time, grab the complete package, including the full 65-page guide + 3 exclusive bonuses - at a launch price you won’t see again.

This is your moment to stop leaking money and start stacking it.

StackAndFree Fund Accelerator PDF

$17 USD

VAT/Tax Include

4.8 / 5 based on 1,211 reviews

Full 65 Page StackAndFree Fund Accelerator PDF

BONUS 1: Top 8 Investment Tools Used by the Top 1%

The same digital tools top 1% investors rely on - simplified for everyday earners ready to take control.

BONUS 2: 25 Books the Banks Don’t Want You to Read

Eye-opening reads that expose how money actually works - and how to build generational wealth outside the system.

BONUS 3: 8 Passive Income Ideas (Under 10 Min/Day)

Low-effort, beginner-friendly income starters to help you create margin without burning out.

Still Got Questions?

Here's The Answers

What exactly will this guide teach me?

This guide walks you through a 25-step, proven system to stop living paycheck to paycheck, track your money with confidence, and build your first $10,000 emergency fund - even if you’ve tried budgeting before and it never stuck. It covers mindset, automation, daily spending, income planning, and long-term consistency.

Is this guide suitable for beginners?

Absolutely. It’s designed specifically for everyday earners - freelancers, creatives, professionals, side hustlers, and parents - who make decent money but feel like it always disappears. No financial background needed. No jargon. No overwhelm.

Do I need a large amount of money to start?

Not at all. In fact, Step 1 assumes you’re starting from zero - maybe even behind. You’ll start by stacking your first $500 before aiming for $10K. The system works regardless of income level, because it’s about control, not just cash.

How quickly can I see results?

Many readers report mindset shifts, awareness, and quick wins within the first 3 days. Depending on your situation, you can begin saving your first few hundred pounds within 30 days - and see major traction in 3–6 months with consistency.

Will this guide work for me if I’m already investing?

Yes - especially if you’re investing without a strong budgeting or cash flow system in place. This guide helps you build the foundation that smart investing depends on. You’ll also get a bonus Top 8 Investment Tools Used by the Top 1% and tools to organize your wealth-building more effectively.

What resources come with the guide?

In addition to the full 65-page StackAndFree PDF, you’ll also get:

- Top 8 investment tools used by real wealth builders

- 25 must-read finance books the banks don’t recommend

- 8 passive income ideas that take under 10 minutes/day

All delivered instantly after purchase.

How is this different from free advice I can find online?

Free advice is scattered, vague, and often contradicts itself. This guide is structured, proven, and designed as a step-by-step transformation - not just tips and theory. It’s built to solve a specific problem: you make money… but don’t know where it goes. We help you fix that, fast.

Is there a guarantee if I’m not satisfied?

While we can’t offer refunds on digital products, we’re confident in the value this guide brings. The strategies inside are designed to help you save and grow your money - many users report getting more than their money’s worth within days of implementing the tips.

What if my income isn’t consistent month to month?

Perfect - the system was actually built with freelancers, creatives, and side hustlers in mind. You'll learn how to map your money based on when you get paid (not just the calendar month) and how to create flexible buffers, priority-based spending, and smart automation that adjusts with your income flow.

I've tried budgeting apps before and they never stick - how is this different?

Most budgeting tools focus on tracking after the fact. This guide helps you design a system before you spend, so you stay in control from the start. It’s not about logging receipts or obsessing over every penny - it’s about building habits and structure that actually work with your real life.

4.8 / 5 based on 1,211 reviews

All rights reserved StackAndFree

Disclaimer:

This guide is provided for informational purposes only and does not constitute financial, investment, or legal advice. The content is based on research and personal experience and is intended to share general information about financial concepts and strategies. Individual financial situations vary, and it’s important to consult a qualified financial advisor before making any investment or financial decisions. We do not guarantee specific results, and all investments carry risk. The creators and distributors of this guide are not responsible for any losses or damages resulting from actions taken based on its contents.